The term “intestate” refers to a situation where a person passes away without leaving behind a valid Last Will and Testament or trust providing instructions regarding the distribution of their estate assets. When this happens, the distribution of the deceased’s estate is governed by the intestate succession laws of the state where they resided at the time of death. Relying on intestacy laws can lead to various complications during the probate of your estate along with failing to distribute your estate according to your wishes. A Murfreesboro estate planning attorney at Bennett | Michael | Hornsby explains why you do not want to leave behind an intestate estate in Tennessee.

Drawbacks of Leaving Behind an Intestate Estate in Tennessee

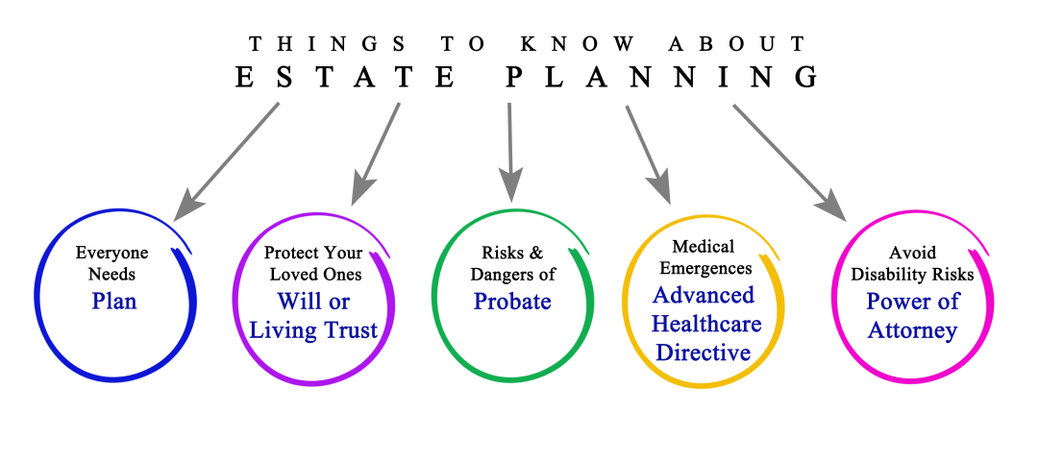

The single biggest – and most common – estate planning mistake is failing to plan. People procrastinate when it comes to estate planning for various

reasons, including the belief that they are too young to need a plan or that an estate plan is only necessary when you own significant assets. The truth, however, is that there are numerous reasons to avoid leaving behind an intestate estate in Tennessee, including:

- Lack of Control over Asset Distribution: One of the most significant drawbacks of intestacy is the loss of control over how your assets are distributed after your death. Without a Will, Tennessee’s intestate laws dictate the division of your estate assets based on a predetermined hierarchy of heirs, which may not align with your preferences. This means that assets may end up in the hands of individuals whom you may not have chosen as beneficiaries and people or causes dear to you may receive nothing from your estate.

- Potential Family Disputes: Intestate succession can sometimes lead to conflicts among family members, especially if there are disagreements about who should inherit what assets. Without clear instructions provided in a Will, disputes are more common and more likely to require time consuming and costly litigation.

- Delayed Distribution of Assets: Probate is the legal process that your estate must go through after you pass away. Probating an intestate estate can be a complex and time-consuming process. Without clear guidance from a Will, the probate court must determine the rightful heirs and oversee the distribution of assets, which can lead to delays in settling the estate. This delay can cause financial strain on surviving family members who may rely on the timely distribution of assets for support.

- Increased Administrative Costs: Administering an intestate estate often involves additional administrative expenses because without a Will to streamline the probate process, the court may need to appoint an administrator to manage the estate, which can result in higher costs and fees. Those additional fees and costs can ultimately diminish the value of the estate passed on to heirs.

- Limited Protections for Non-Married Partners: In Tennessee, intestacy laws prioritize spouses and blood relatives when distributing assets. This means that non-married partners, regardless of the length of their relationship, are not entitled to inherit anything from an intestate estate unless specifically provided for in a valid Will. Leaving behind an intestate estate could leave your partner financially vulnerable and without any legal protections.

- Inability to Plan for Minor Children: For parents with minor children, having a Will is crucial for outlining guardianship preferences. In the absence of a Will, the court will appoint a guardian for minor children without any guidance from the deceased parent. Moreover, because your minor children cannot legally inherit directly from your estate, establishing a trust to manage assets on behalf of your children is another important aspect of a comprehensive estate plan. Dying intestate can result in decisions that may not align with your wishes regarding your children’s care and inheritance.

- Missed Opportunities for Charitable Giving: Without a Will or trust, you lose the opportunity to support charitable endeavors that you value and that you may have made a commitment to continue supporting.

Leaving behind an intestate estate in Tennessee can have significant negative repercussions for your loved ones and your legacy. To avoid these unwanted outcomes, consult with an experienced estate planning attorney as soon as possible to get started creating your estate plan.

Contact a Murfreesboro Estate Planning Attorney

If you are ready to get started on your estate plan, consult with an experienced Murfreesboro estate planning attorney at Bennett | Michael | Hornsby as soon as possible. Contact the team today by calling 615-898-1560 to schedule your free appointment.

- The Art of Successful Co-Parenting During Divorce - April 19, 2024

- Elder Financial Exploitation: How to Protect Seniors - April 12, 2024

- How to Obtain Guardianship of a Minor in Tennessee - April 2, 2024